In the world of finance, few names carry as much importance as BlackRock.

Known for its massive scale and influence, BlackRock is a global leader in asset management.

But what exactly is BlackRock, and why does it matter? In this blog post, we’ll explore BlackRock’s origins, operations, and influence, and highlight why it plays such a vital role in the financial industry.

A brief History

Founded in 1988, BlackRock began as a small risk management and fixed income institutional asset manager.

Its founder, Larry Fink, and a team of financial professionals aim to provide superior risk management solutions to institutional investors.

The company’s innovative approach to managing fixed-income investments and its emphasis on technology and risk management immediately set it apart from its competitors.

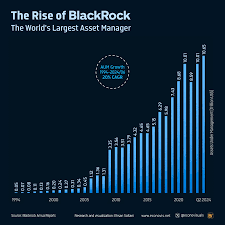

Over the years, BlackRock expanded its offerings and geographic reach.

Its growth was boosted by a series of strategic acquisitions, including the purchase of Merrill Lynch Investment Managers in 2006 and the acquisition of Barclays Global Investors in 2009.

Today, BlackRock stands as the largest asset manager in the world, overseeing trillions of dollars in assets . . .

What does BlackRock do?

BlackRock’s primary function is asset management. This means that it manages investments on behalf of a variety of clients, including pension funds, governments, and insurance companies as well as individual investors.

The company provides an extensive array of investment products and services, such as:

Equity and fixed income funds: These include mutual funds, exchange-traded funds (ETFs), and other pooled investment vehicles.

Alternative Investments: BlackRock provides access to hedge funds, private equity, and real estate investments

Risk Management and Advisory Services: The firm provides advisory services to help clients manage investment risks and make strategic decisions.

Sustainable Investing: BlackRock has increasingly focused on ESG (environmental, social, and governance) criteria, promoting sustainable and responsible investment practices.

BlackRock’s influence

BlackRock’s size and scope give it significant influence over global financial markets.

With trillions of dollars in assets under management, the company has substantial stakes in many companies around the world.

This establishes BlackRock as a key player in corporate governance, as its voting power at shareholder meetings can influence important decisions at many publicly traded companies.

The firm is also a leading advocate for sustainable investing.

BlackRock’s CEO, Larry Fink, has been vocal about the importance of addressing climate change and incorporating ESG factors into investment decisions.

This stance has not only influenced other asset managers but has also contributed to a broader shift toward sustainable investing practices across the industry.

Technology and innovation

A key component of BlackRock’s success is its emphasis on technology.

The firm’s proprietary platform, Aladdin, is a comprehensive risk management and investment management system used internally and by other financial institutions.

Aladdin integrates portfolio management, trading, and risk analysis, providing clients with powerful tools to manage their investments and assess risks.

Challenges and criticisms

Despite its success, BlackRock is not without controversy.

The company has faced criticism over the concentration of corporate power and its influence over global markets.

Some critics argue that its size could pose systemic risks to the financial system, while others raise concerns about the ethical implications of its investment choices, particularly in sectors such as fossil fuels.

The Future of BlackRock

As BlackRock continues to grow, it faces both opportunities and challenges.

An increasing emphasis on sustainable investing and technological innovation presents significant potential for growth.

However, dealing with regulatory scrutiny and maintaining its reputation amid global financial uncertainties will be critical to its continued success.

conclusion

BlackRock is more than just a financial institution; it is a cornerstone of the global asset management industry.

Its broad reach, innovative approach, and influential position make it a key player in shaping investment strategies and corporate governance around the world.

As you consider the broader implications of financial institutions on our world, understanding BlackRock’s role provides valuable insight into the dynamics of global finance.